From time to time, I chat with investors who make the erroneous assumption that all real estate deals are similar for the most part, both valuation-wise and operations-wise. What happened to “location, location, location”? Economies come and go. Cities come and go. Neighborhoods come and go. Buildings come and go. Navigating real estate investment is a challenging endeavor which requires skill and mazal.

The Big Picture

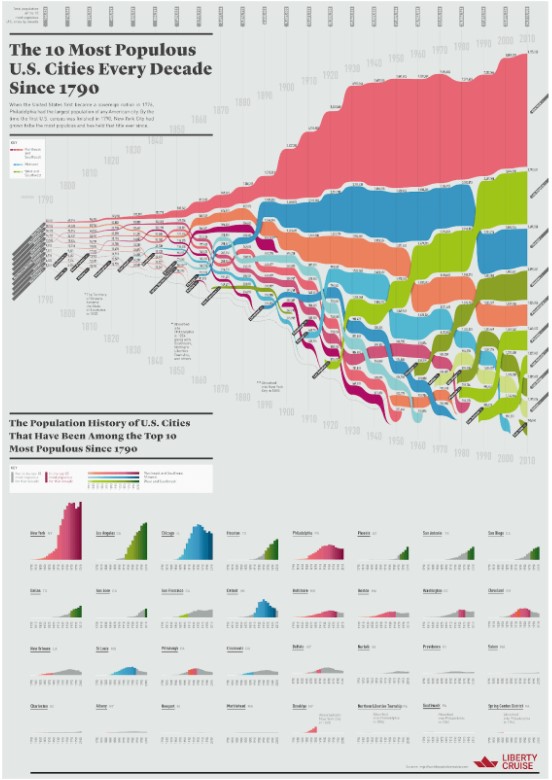

This infographic illustrates beautifully the evolution of and variability over time among the US’s major cities. (2020 data is similar except that Philadelphia and Phoenix traded places on the list.) On a big-picture level, it’s fascinating to note that revolutionary New York, Boston, and Philadelphia combined had fewer people than Lakewood does ka”h. The flow of colors also broadly highlights the country’s origins in the Northeast (red), the manufacturing Midwest’s powerful rise in the early 1900s (blue), and the more recent booms of the Southern and Western Sunbelt (green). The USA is a place of great change when viewed through the lens of time.

Big Shifts

Cities can also experience drastic shifts of fortune, with Detroit being an obvious example. Detroit’s population and prominence exploded beginning around 1910, as Henry Ford’s Model T burst onto the scene. After peaking in the 1950s, the Motor City population declined and then collapsed as racial riots and competition from Mitsubishi, Toyota, and Honda weighed heavily on the city’s prospects. These massive demographic shifts obviously had an overpowering effect on real estate values. The real estate maxim about location masks the trickier reality that, over time, the best location can become the worst and vice versa.

New York’s Journey

New York City, the city that had the most influence on most readers of this column, has its own unique trajectory told in this chart. It’s easy to imagine that our community’s affinity for real estate is heavily colored by the fact that New York City has been an almost continual boomtown for the past 30 years. But this wasn’t always the case. Note New York’s massive population collapse of the 1970s as the city was torn apart by politics, crime, recessions, and interracial disturbances. New York real estate wasn’t immune to this upheaval.

When I attended yeshivah in Boro Park in the ’70s and ’80s, entire blocks of apartment buildings sat burned and abandoned across the street. Other sections of the city looked much worse. Those who paid full price for local real estate in the ’60s and ’70s were significantly damaged as the city’s population and prices plummeted. Conversely, those who bought up those depressed buildings for pennies in the 1980s (including R’ Moshe Reichmann z”l) made unbelievable fortunes as the city turned the corner and boomed again.

Booms and Busts

It may not be apparent during the boom times, but as this chart highlights, things change. When the going gets rough, as it tends to from time to time, the specific city, neighborhood, building, and manager you’re invested in can matter greatly. Macro trends such as interest rates and economic conditions heavily influence the investment landscape. Prices definitely matter a lot too—you may do a lot better investing in a metziah in a weak city or neighborhood versus seriously overpaying in a strong location. Navigating these factors takes wisdom, skill, and mazal.

The Three Ds

I’m a huge fan of real estate investing—no other asset class comes close to its potent combination of growth potential, safe leverage, and tax benefits. But real estate also isn’t the no-brainer decision that some may assume it is. It always requires the fundamental three ds: davening, due diligence, and diversification.

Want to dig deeper?

Try these related articles

Managing The Risks Of Real Estate Investing

Successful Real Estate Investing: 3 Key Strategies

Hands-On Real Estate Investing: A Well-Trodden Path to Building Wealth