You may have heard the word cryptocurrency and have no idea what it is. That’s okay; all you need to know is that it is the hot thing people are putting their money into today. Prices of electronic “currencies” have skyrocketed, and fortunes have been made overnight. Some cryptocurrencies may have very bright long-term futures, and prices may keep booming for some time. But because there’s clearly a bubble going on, they can just as easily suddenly fall to zero.

A Canned Air Bubble

Everyone loves a story, so here’s one to illustrate how a financial bubble develops and how silly it can get.

“So, I was thinking of taking some money and investing it in canned New York City air,” Shlemiel told his wife, Sarah, after dinner.

Sarah looked at her husband. “Canned air, like air from outside pumped into an empty can? Isn’t that just a silly tchtotcke sold to tourists as a souvenir?”

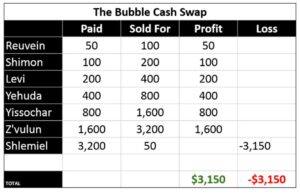

“Yes. Well, no. Now it’s also an amazing new investment.” He paused. “Reuvein bought a can for $50, then he sold it to Shimon for $100. Shimon sold it for $200 to Levi, and he flipped it to Yehuda for $400. It’s a consistent pattern, a totally solid investment.”

Sarah continued to stare at him.

Shlemiel pressed on. “They all doubled their money, so what am I waiting for? I should be the next guy!”

“Yes, but canned air?” Sarah repeated.

“It’s not about the air, it’s the money.”

“I thought investments were for things that have real value and growth potential.”

“True, kind of, but sometimes, you just gotta get in and make the value, grab it before others do,” Shlemiel tried explaining.

“That makes no sense to me.”

Shlemiel frowned. “It doesn’t make sense to me either,” he admitted. “But it’s working. Look how much money people are making. I hear Yehuda was able to get $800 from Yissochar—he made $400 profit in an hour! It has to make sense; otherwise people wouldn’t be investing in it. Actually, I’m getting in at the best time. Watch me make more money than the guys that already sold.”

“Maybe.” Sarah shrugged.

“Trust me on this, Sarah—this one is the real deal.”

Shlemiel left for Maariv a bit early and saw Yissochar shmoozing near the coatroom.

“Yissochar, I wanted to talk to you about buying your canned air.”

Yissochar glanced at the fellow he’d been chatting with, his face wreathed in a coy smile.

“There’s nothing to talk about. I just sold it all to Z’vulun here for $1,600.”

Shlemiel’s stomach dropped. This was getting pretty pricey. “How much?” he asked Z’vulun.

“Thirty-two hundred.”

“Sold.” Shlemiel said, pulling out his checkbook.

For the next few days, Shlemiel strutted the streets. He was a smart investor; he was going to make the easiest $3,200 ever. But then it struck him: Why had no one offered to buy his golden opportunity? Where was the eager investor who’d cash him out in an effort to grab the biggest profit of all?

That night, he spied Yissochar again before Maariv.

“So, how much did you sell the canned air for?” Yissochar asked him.

“I didn’t sell yet,” Shlemiel said. “I still have it.”

The pity was apparent on Yissochar’s face “Oh. That’s too bad. Nobody’s flipping air anymore. That can is back to selling for $50 max as a tourist souvenir.”

Shlemiel’s jaw went slack. If so, he was out $3,150! How could the value have disappeared so quickly?

“Look, you’ll make it all back and more with some Beanie baby dolls. Everyone’s buying them, and you can make a killing. You want in?” Yissochar said.

“That’s just a kids’ toy, not an investment, ” Shlemiel pointed out.

Yissochar shrugged. “Everyone who buys it doubles their money.”

Shlemiel frowned. Wasn’t he recently told that about canned air? He slunk away. It seemed that the investment world really wasn’t for him.

Bursting a Bubble

There is centuries worth of documented evidence of financial bubbles. They are often triggered by a very real technology or investment opportunity which triggers irrational excitement. There’s a kernel of truth in a good bubble—after all, a big lie always needs a bit of truth to stand on. At some point, as prices quickly rise, people begin to disregard the actual value and investment potential of the venture because all they intend to do, after all, is buy it to flip and sell at a higher price. That’s when things really go crazy.

As tales of wealth begin circulating, people look at those gains as proof of concept. If people are making money, then it “must” make sense. The cycle continues and accelerates, ever expanding. The price gets more and more ridiculous, yet it makes more and more sense to invest because the gains keep growing even larger! Eventually, the cycle is broken when people finally realize that “the emperor has no clothes.” At that point, the price usually doesn’t go down slowly; like a bubble, it pops and the air goes back to its original value.

Mostly a Gamble

Note that in our little mashal, everyone made money except the last guy. In fact, Shlemiel’s losses equaled exactly everyone else’s gains! In the froth of a bubble, the winners and losers simply swap money. It’s essentially the same as any card game or casino-gambling operation. Unlike in a true investment, no value or societal benefit is created when money changes hands in the closed system of a bubble. (As mentioned, there is a kernel of true investment going on in a typical bubble. In our case, there are legitimate technologies and companies being built within the crypto industry, and the bubble is inflated upon this core.)

Watch the Risk

Bubbles are exciting but financially dangerous—you never know when they’ll pop or who will be left holding the bag. In the long history of bubbles, the tulip mania of the 1600s, South Sea bubble of the 1700s, railroad mania of the 1800s, and the more recent internet stock craze all involved a buying frenzy, a lot of money churned, and a lot of hopes pinned. But ultimately, each time dreams were dashed and money dissipated in an instant. A lot of people made money—but only if they got in and out before the bust, or picked the Amazon needle out of the haystack of junk! If you do put your money in a bubble, do it with your eyes wide open.

Want to dig deeper?

Try these related articles

Bubble Trouble—Investing during an Illogical Boom