Is Hands-On Real Estate Investing For You?

I’m a huge believer in the earning potential of well-located property. Real estate investing has long been a fantastic way to make significant, relatively secure returns. And the greatest potential rewards are available to those who are willing to roll up their sleeves and buy property themselves instead of via funds or partnerships.

Buying, financing, and renting out a house on your own isn’t rocket science. And while there are pitfalls to be navigated, residential real estate is a tried and tested path to build wealth. Indeed, millions of everyday investors use it to generate significant returns with contained risks.

Regular-Guy Landlords

When people think of landlords, they may imagine moguls with portfolios of large apartment buildings. However, according to data from the Census Bureau and the National Multifamily Housing Council, only about a third of renter households live in communities with over 100 apartments (16 million out of 43 million total). Another third of tenants live in smaller multi-unit buildings, and the final 14 million families rent single-family homes. Most of these single-family landlords are regular folks who buy a house, or perhaps a few, for investment purposes. And so many pursue home rental investing because making good money in it is not too difficult.

Pretty Straightforward Homework

The research required to decide on a solid home rental is basic and common-sensical. Is this a stable or, better yet, a growing neighborhood? Is it a safe, clean area? How much do houses go for now, and historically? What’s the rental market like? Calculate taxes and other expected expenses such as insurance and basic maintenance. Most of this information is easily accessible via a Google search or a phone call to local brokers, town officials, and service providers. In fact, most people have already done this kind of homework when they were buying a home to live in. Now, they can do it again to buy a profitable investment house.

Help Closing the Deal

Getting a mortgage and closing the deal for a house is also a well-trodden path. Can something fall through the cracks when buying a house? Sure. But it’s relatively rare for something to really blow up in the residential world, as long as buyers retain competent help. There are many experienced home inspectors, mortgage brokers, attorneys, and title companies who smooth out the process. The very advantageous 15- 30-year mortgages available to homeowners are accessible to landlords, too, under pretty similar rates and conditions. Access to these flexible loans is one of the main reasons why residential real estate is such an attractive investment category.

Management Can Be Manageable

Besides finding the right house and coming up with a down payment, a big concern for many is the burden of property and tenant management. Unlike landlords of buildings, most small investors don’t have the luxury of relying on a reliable super to deal with such hassles. Finding a good tenant can take time and effort; occasionally, they may not keep their end of the deal. This means a legal fight, even perhaps a very discomforting eviction. Every property also requires ongoing maintenance and repairs.

These nuisances tend to pop up at the most inconvenient times! There’s no sugarcoating this: real estate investing isn’t as neat and tidy as buying stocks. Everyone involved in hands-on real estate needs to be prepared to roll up their sleeves from time to time. But, don’t let that dissuade you from at least considering this popular path to wealth creation. Many find the rewards of real estate ownership well worth the headaches. You can often find reliable property management companies that will relieve a lot of the burden.

Booms, Busts, and Reality

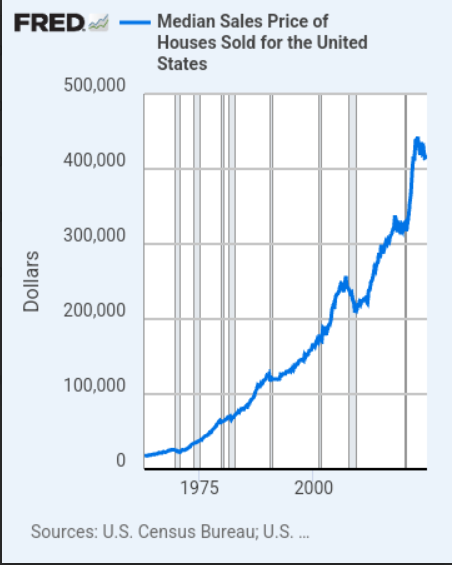

There are many misconceptions about realistic real estate investment returns. We can marvel at the fortunes made and lost from quick flips or spectacular busts. Sure, spectacular real estate profits and losses happen all the time for those trading quickly with massive debt loads. But generally, such dramatic price rises are followed by years of stabilization with little to no gain. Or even losses.

Unless someone has tremendous mazal or trading acumen (or vice versa), the good, medium, and bad years tend to average out. Seasoned long-term investors expect solid but not eye-popping profits across multiple real estate cycles, properties, and players. Being aware and realistic about navigating narket cycles will help you tremendously in the long run.

Long-Term Rewards

Based on my experience and research, reasonably managed real estate investments have averaged 5-10% annual returns before leverage. These numbers combine rental income (after expenses) and price appreciation. However, with the smart use of debt, patient investors can often bring that baseline up to 10-15% or even more.

Add property owners’ tax benefits, and it’s clear why so many fortunes have been built upon this excellent asset class. Of course, there are huge variations in actual profits based on skill and mazal, but the potential rewards are definitely there.

But It Can Go Wrong, Too

Don’t get me wrong, though. Making solid investment returns from real estate requires real work, which not everyone can pull off. Assumptions about rental income can be off. Occasionally, an inspector does miss a serious environmental or structural issue. Or a nightmare tenant drags out an eviction for months and then destroys the property as a goodbye gift.

Unlike a boring REIT mutual fund, even one real misstep with real estate can easily consume most or all of your money. Real estate investment offers excellent possibilities. But risk and reward usually go hand in hand.

How to Get Educated: Studying, Talking, Doing

To learn more about what success or real estate investing entails and to prepare to jump in, I recommend reading a couple of good books, or even taking some of the many affordable online courses available. There’s no need to spend a fortune; some courses charge top dollar for entry-level information packaged with much fluff.

And talk to people. There are many real estate pros in the community. Talk to a good number of them, and you will get a feel for the realities of what this entails and if it is for you. For many, it can be an amazing side hustle hishtadlus and is definitely worth considering.

Want to dig deeper?

Try these related articles

The Easiest Way to Invest in Real Estate

Managing The Risks Of Real Estate Investing

Real Estate Investing: An Ever-Changing Opportunity and Challenge