Is Everyone Wealthy?

There’s a common misperception today that “everyone” is rolling in dough—every else, that is. After all, look at all the bustling, high-end stores, glossy ads, exotic vacations, massive mansions, lavish simchos, and opulent events. The sense that one is missing out on their share of society’s unlimited wealth generates much angst, making many wonder what secret they are missing that’s causing them to fall behind. Some people are extremely ashamed if they need to request tuition discounts or assistance with weddings, and others feel the need to spend more than they can afford even if that means going into debt.

Most Are in the Middle

But the fact is, most of the community just about gets by financially, more or less. Sure, a small percentage are super well-off and another fraction are, sadly, desperately poor. But these extremes are what stand out, giving the false impression that everyone is either earning millions and “living it up“ or surviving only with regular Tomchei Shabbos packages. In actuality, the bulk of people fall into a middle-class economic existence. And there’s absolutely no shame or worry in that reality.

A Picture from the Nishma Survey

Bear in mind that it’s hard, almost impossible, to get a totally accurate picture of a community’s income and expenses no matter what the surveys, research, and anecdotes express. However, despite these limitations, multiple data sources clarify that on a big-picture level, simplistic assumptions about how great “everyone” is doing aren’t true.

For example, Nishma Research published back in December 2021 the results of a survey they conducted on the finances of Orthodox Jewish life. The survey asked frum people to provide hard numbers, such as annual income, assets, savings, and retirement savings, as well as how they perceive their financial state. Nishma is honest about potential survey inaccuracies—it was conducted mainly online, which skews the numbers, and many are hesitant to provide detailed specifics about their financial lives. Even so, the eye-opening results ring true.

What are Families Really Earning?

According to Nishma, as of December 2021, median household income in America’s chareidi community is $136,000. 78% of respondents earn under $225,000. In other words, the vast majority of our community is not earning exorbitant incomes and, given the expenses of a basic frum lifestyle, most do not have lots of money for luxuries. When it comes to savings, the picture is similar: over a third of families reported under $10,000 in short-term savings, whereas less than 20% have savings of $100,000 or more. When it comes to retirement savings, 57% said they have less than $50,000 saved for a long-term nest egg. Although this was conducted back in 2021, the point remains true. The majority of our community is not as wealthy as they seem.

The 10-40-40-10 Distribution

A deeper look at the report clarifies that our community’s financial standing looks like a bell curve, with a roughly 10-40-40-10 distribution. The upper 10% can comfortably afford not just basics but also luxuries, if they want them, and significant investments; they are also the ones who are heavily supporting our mosdos and their less wealthy counterparts. The next 40% is earning enough to make it on their own with a bit left over for some extras and modest saving and investment. The lower 40% needs some government aid and family assistance to cover their budgets, and the lowest 10% is not making it at all—they are being heavily supported on a regular basis by communal tzedakah funds on top of social programs.

I wouldn’t put too much stock in any one survey, but Nishma’s research generally jibes with other data sources, including IRS tax data and studies from the Pew Research center. More vague but most credible, anecdotal evidence from people who have access to the community’s larger financial picture, such as school administrators, askanim, and accountants, reinforces our assertions that our financial bell curve mirrors that of the general American population. True, the income numbers are skewed higher, but so are our expenses.

Appearances are Deceiving

If this is the real picture of our community’s earning capacity, why does it seem like everyone is making lavish chasunahs, building massive homes, taking first-class annual family vacations, and donating large sums to tzedakah?

Firstly, just because someone is making a fancy simchah or driving a luxury vehicle doesn’t mean they can afford it; there’s a tremendous amount of debt being utilized by those who choose to live beyond their means (airline miles play a part too!). A lot of conspicuous spending is driven by those trying desperately to “keep up with Cohns”. Secondly, many middle – and lower-tier – earners are getting significant help from their much-wealthier family members, enabling them to spend well beyond their own income-generating capabilities.

The Magnified Extreme

This second point opens up a window into the larger distortionary factor of communal economics: the magnified effect produced by top tiers of income and wealth. Think of it this way: There are about 15,000 frum families in the broader Lakewood area. Assuming 10% are earning big bucks, that means there are 1,500 families with significant earning power, more than enough to support many luxury restaurants, car dealers, jewelry stores, clothing boutiques, party planners, etc. And these stores and vendors will logically upgrade their wares and market them heavily. After all, there’s a lot of money at stake even though the real target market is relatively small.

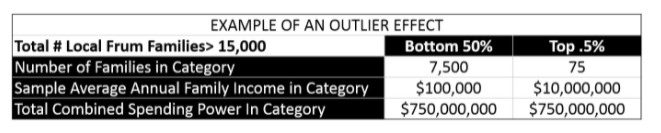

Furthermore, take a look at the small chart included here. I don’t know exactly how much annual income the bottom 50% of our community’s households (7,500 families) averages vs. the top-earning 0.5 percent (750 families), but those numbers can be illustrative. Regardless of the specific amounts, it demonstrates how even a small number of outliers who are earning massive sums can have an astounding impact on a group’s every financial aspect. Seventy-five families can be earning as much or more than 7,500 families! Though this group is a tiny sliver of our community, it makes a huge economic splash.

The Takeaway: Adjust our Attitudes

Bottom line, much of our financial stress is artificial, based on the perception that everyone else has it much better than we do. In reality, the vast majority are just making it, and when a large expense like a chasunah arises or some crisis brews, many are getting significant assistance from wealthy family members and/or borrowing money to pay for it.

While it may be true that the small percentage of uber-wealthy families shouldn’t raise the bar excessively (and very many of them don’t), others shouldn’t be trying to run after them spending-wise. Throwing a lavish simchah you can’t afford or building a mansion using only massive mortgages usually doesn’t fool anyone. Realizing that nearly everyone you know is in the same general financial orbit as you can alleviate much of the pressure to put on a façade. And knowing that many in our community need some sort of financial assistance at some point, despite working hard and living modestly, can remove the shame and guilt should one be compelled to take.

Chazal said it long ago: “Eizehu ashir? Hsameach b’chelko. ” It’s all in our minds.