One “Box” Does it All

In other articles, I discussed the caveats of just dumping money into an S&P 500 fund. It’s a great fund, but no professional investment strategist would consider it an entire portfolio. However, there are outstanding “Portfolio in a Box” options today, enabling investors to make any size account work for them, doing all the investment work at little cost and with any size account.

Before jumping in, let’s return to the basic concepts for a moment. Mutual funds pool together money from thousands of people to invest in a specific strategy or niche. This pooling spreads the costs of hiring top money managers across the whole group. At a very low cost, investors benefit from professional management and excellent customer service. Today, most people who use the stock or bond markets to grow wealth do so via mutual funds.

Which to Choose?

But there are many thousands of mutual funds available—some risky, some staid, some well managed, some not so. The challenge of selecting the right mutual fund portfolio—which includes assessing those investing in stocks versus bonds, US stocks versus international stocks, large company stocks versus small, government bonds versus corporate, etc.—is beyond many everyday investors. And when market conditions change, who decides how to shift among these niches to balance potential risks and rewards properly? Enter the asset allocation fund or target-risk fund, a small niche within the mutual fund world.

The All-In-One Mutual Fund

The best asset allocation mutual funds incorporate virtually everything required to maintain a complete portfolio in a single, low-cost package or fund. All the investor needs to do is decide on the portfolio objective or targeted level of risk-aggressive growth:

- Growth, with the most upside and downside potential

- Moderate growth

- Conservative growth

- The relatively low risk of volatility but limited growth opportunity of an income portfolio

Then, the mutual fund managers do all the rest to pursue the selected objective. As long as personal objectives haven’t changed, a good target risk fund can and should be left alone for years, even decades.

Vanguard’s Asset-Allocation Offerings

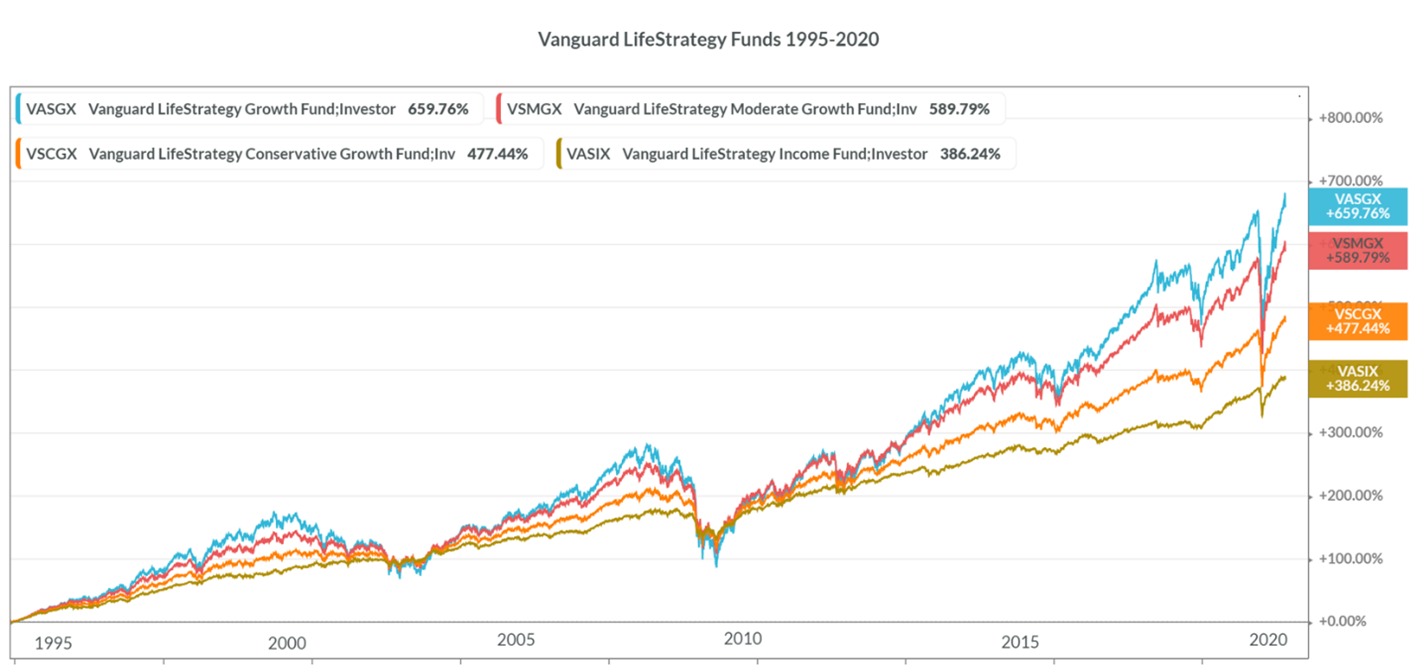

By way of example, I’ve graphed Vanguard Investments’ LifeStrategy asset-allocation funds, which come in four risk levels: growth (80% stocks/20% bonds), moderate growth (60/40), conservative growth (40/60), and income (20/80). With a minimum investment of just $3,000, investors can simply select how much risk they want to take and let Vanguard’s managers do the rest. Once the minimum is met, additional sums in any amount can be deposited. These LifeStrategy funds cost less than 0.15% annually, about 85% less than similar mutual funds, and cut out any adviser commissions and fees, too! I love these “Portfolio in a Box” funds and think many investors can benefit from them.

But How Did They Do?

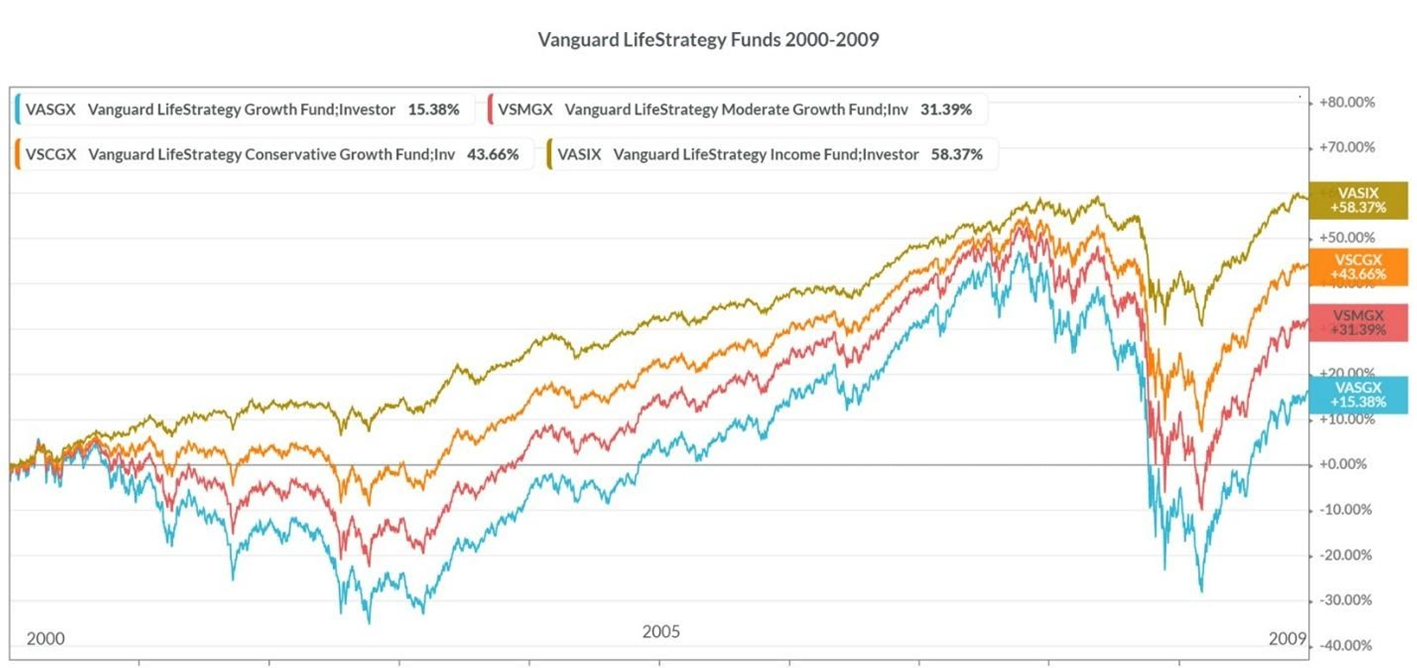

These funds have performed very nicely, if not spectacularly, and in line with their risk profiles (see the first graph). Since they began in 1994, through mid-2024, the growth fund (blue) grew by 919% (a bit over 8% compounded annually), the income fund (red) gained 389% (about 5.5%), and the moderate (green) and conservative (orange) yielded returns in between those two. The growth fund had the greatest returns in the long term but, as expected, was also by far the most volatile. During a difficult decade for stocks, from 2000 to 2009, the growth fund underperformed the low-risk income fund even as investors in the income fund had a much smoother ride (see the second graph). More potential reward. More potential risk.

A Very Good Bet

It’s mind-boggling how you can get a professionally managed portfolio with such minimal restrictions and fees. Because they use index strategies, the LifeStrategy portfolios are well diversified, tax efficient, and not dependent on any one superstar to manage them. While no one knows the future, I think it’s a good bet that the tried-and-true LifeStrategy funds will serve investors well for decades to come. With $55 billion already entrusted to these Vanguard strategies alone, the funds have staying power.

Another Great All-In-One Option

If you don’t meet Vanguard’s $3,000 minimum, another excellent group of asset-allocation funds to consider is iShares Core Allocation Funds (tickers AOK, AOM, AOR, AOA), managed by another investment giant, BlackRock. These all-in-one funds are almost identical to Vanguard’s, and feature four options, ranging from aggressive growth to conservative growth. Unlike Lifestrategy funds, they can be bought in any dollar amount. Also, (since they are structured as ETFs) iShares are available without brokerage fees via any stock brokerage account such as Fidelity, Schwab E-Trade, Robinhood, etc., whereas Vanguard’s LifeStrategy funds may require a Vanguard account.

So What Are Advisers For?

But if solid investing can be so easy and accessible, why would someone pay good money to an investment adviser? It’s a good question, and indeed, many investors with simple scenarios do NOT need an adviser. Today’s real benefit from a personal financial adviser is in the financial planning and hand-holding. Good advisers help clients answer fundamental questions such as:

How should I save for various goals? How much risk is reasonable for me to undertake? What tax shelters and moves can I use to increase investment returns? How much and what type of insurance do I need? What should I do with investments that didn’t work out? How do I generate income for retirement?

Perhaps most importantly, though, people often thwart themselves—just because we know what to do doesn’t mean we do it. Many investors never follow through, never actually save and invest, no matter how simple it may be. Others only invest when things are rosy and pull out when the going gets rough. Paying someone to get you on track and then to stay the course is often well worth it.

However, many people who call themselves financial advisers do not offer the aforementioned hand-holding, especially to investors with smaller sums. In that case, you might as well stick to target risk funds, avoid unnecessary fees and commissions, and save a boatload of money.

Want to dig deeper?

Try these related articles

The Reality of Investing in S&P 500 Index Funds

The Power of Index Mutual Funds

Target-Date Funds: A Modern Approach to Simplified Investing