Taking It Too Far

In another article, we explained that low-fee index funds beat most other investment options. Click here to see the full article. So many naturally asked, “Why do financial advisors even exist, then? Are they all a waste of time and space, just marketing fluff? And ahem, Eli, aren’t you a financial advisor? What do you charge your clients for?!?”

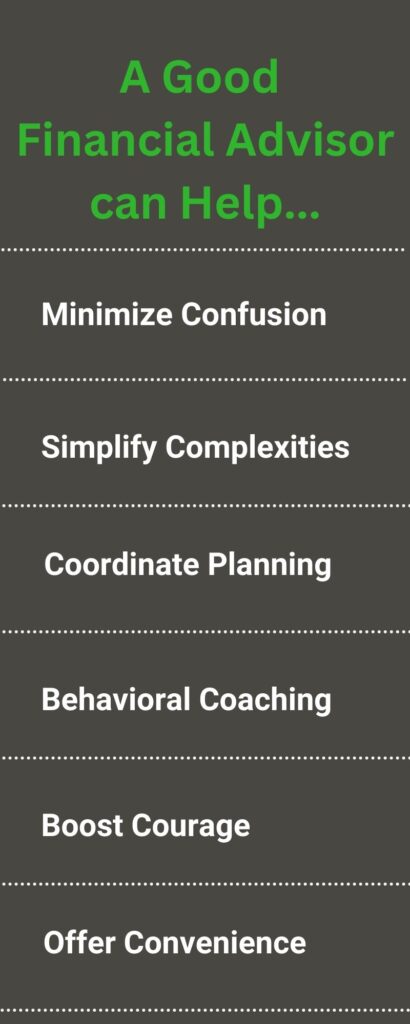

But while index funds are indeed fantastic and straightforward, and many investment advisors indeed do not add much value, good financial advisors are FAR from useless or obsolete. Although someone who is prepared to self-educate extensively may not need a financial advisor, the vast majority of people can use plenty of help managing their money.

(Please note my personal bias here because I own and manage Leatherback Investments, a boutique investment firm. To bring the article’s points home, I will explain at the end how Leatherback adds value to its clients. Judge for yourself if it’s compelling.)

Rampant Investment Confusion

Let’s start with the fact that even within the realm of index funds, there is much confusion. The niche contains hundreds of options, ranging from super-simple and safe to exceedingly complex and risky. Many investors, even the wealthy and intelligent, make no distinction among the bunch. For example, the super-popular S&P 500 Index Fund is not a complete portfolio, and lacking basic knowledge, some newbies choose grossly expensive versions of this otherwise excellent mutual fund option. Index funds should indeed be the core of most investors’ liquid portfolios, but many need help securing even these fundamental products.

Simplifying Investment Complexities

Even after one narrows down their list of mutual funds, investment planning is far from over. How much you should allocate to each of those fund categories (stocks vs. bonds, etc.) depends on your time horizon and risk tolerance. Very often, an investor has multiple investment goals—say, saving for simchas, a down payment, and a 401(k) plan—all of which require different portfolio allocations.

Investors often also face special situations, such as correcting for prior selections of inferior funds or gifts of random stocks. And how does one balance their mutual fund portfolios versus real estate and private businesses? Professional guidance is often required.

Coordinating Financial Planning

Despite the above points, it’s accurate that index funds, target-date funds, and investing apps have made investment management pretty easy for most investors. Where financial advisors can really add a lot of value is by coordinating intertwined financial matters, such as improving tax efficiency with IRAs, 401(k)s, 529 plans, and myriad other strategies; insurance reviews, estate and charitable planning, and more. Often, multiple experts are needed to design a financial future, including accountants, insurance brokers, and trust attorneys. A good financial advisor can help coordinate the whole team and facilitate these vital tasks.

Necessary Coaching

Another major thing financial advisors can do is make sure that plans are created and implemented. Most Americans don’t even get to first base with wealth. Without consistently spending less than you earn and investing properly, you never get ahead. But there’s always something to spend your money on now, and as incomes grow, we tend to spend more. That fact is why even many top earners have very little net worth. A financial planner who actually gets things done is often worth every penny. Same for life insurance brokers, by the way. A plan is worthless unless it’s actually put in place.

Courage Booster

In a similar vein, even financial professionals will sometimes hire a colleague to manage their own money to minimize the emotional aspect of investing. Money cuts very deep into our psyche; it is well documented that people become irrationally euphoric or gloomy in relation to it. Jumping onto booming assets at high prices and then dumping investments, even good ones, at the lowest prices is common. Therefore, having a professional, steady hand to dispassionately follow procedures and overcome those very human impulses is a wise expenditure for a significant fraction of the population. It can be expensive NOT to hire an advisor.

Convenience and Peace of Mind

Financial planning is not rocket science; you can learn 90 percent of what you need to know in a couple of books. But neither is most of what we do in our lives. We pay for many things to bring simplicity and convenience to our lives, allowing us to concentrate on our professions and the things we care about. Sure, you can self-educate and become your own financial planner just as you can be your own landscaper, handyman, mechanic, lawyer, dietician, therapist, etc. But most people prefer to specialize in what they are best at and pay for the convenience and peace of mind that comes with relying on other specialists.

But What About the Fees?

DIY extremists dramatize how financial advisory fees are a massive drag on investment returns. And indeed, if you lower investment returns by, say, 1 percent on a decent-sized portfolio, it will cost a boatload of money when compounded over decades. However, that analysis only makes sense if the fees are totally wasted, i.e., the advisor didn’t improve returns. But many studies show that, between tax efficiency and reducing technical and emotional errors, a good advisor can often more than cover the fees they charge. In that case, the added services and convenience financial advisors offer are free, not costly.

Disingenuous Calculations

Even if all an advisor does is save their client time, worry, and distraction, how is that a rip-off? It’s disingenuous to focus only on the cost and not on the service provided. In fact, if you take any significant service fees paid to accountants, personal trainers, therapists, caterers, bakers, barbers, real estate brokers, and others and compound them over 40 years, it will also sum to a surprisingly large number. At the same time, we recognize that the convenience, time savings, and assurance that a job will be done effectively and correctly are often worth the money. A financial advisor who adds value is no different.

The Golden Path

I’m not saying everyone needs a financial advisor, definitely not all the time. It’s also not easy to find the right adviser who will help with all of the aforementioned ancillary services, especially for those with smaller asset levels. But the financial DIY movement has gone too far, making it seem like everyone should be a financial whiz, even though many amateurs are not able or interested in becoming one. The golden path runs down the middle. Do what you can on your own if you wish. Find pros for the rest.

My company, Leatherback Investments, doesn’t offer personal financial planning and wealth management. And that is not how we help clients beyond the simplicities of selecting basic mutual funds.

So how do we add value and justify our fees?

Leatherback helps endowment funds, 401(k) plans, and ultra-high-net-worth investors manage their investment strategies and compliance.

There are many legal and technical matters intertwined with investing for endowment and pension funds, and we help the executives of those entities manage these obligations and liabilities. Not something they want to handle for the most part, since it is very specialized and high-risk.

And institutional and ultra-high-net-worth investors have unique financial needs that aren’t easily researched or managed. And as with good financial advisors and wealth managers, we do include quarterbacking, big-picture planning, and behavioral coaching in our services.

We believe our fees are exceedingly reasonable and add a ton of value, but ultimately, our clients decide on that for themselves!

Bottom line, it’s not really about low fees per se, but ensuring that you get real value for your fees. Sounds similar, but in reality, very different.

Want to dig deeper?

Try these related articles

Index Card Finance: Is It Really That Simple?

Beyond Track Records: Researching Real Estate Investment Managers